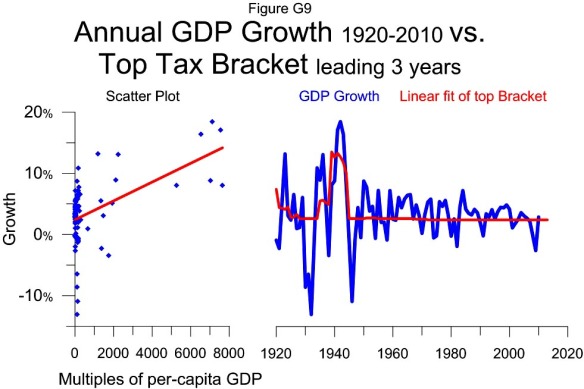

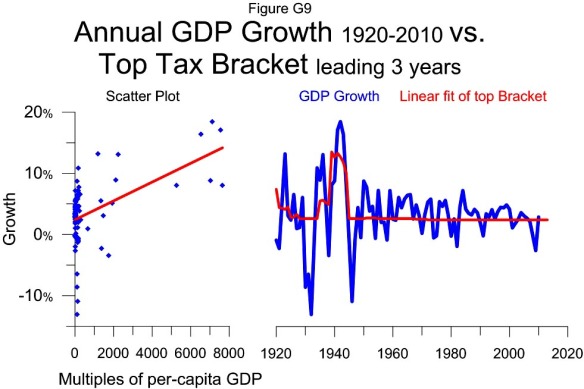

The scatter plot shows that over the last 90 years the top tax bracket has had a positive relationship with growth. This is demonstrated by the upward sloping best fit line in the scatter plot. The strongest year of growth, represented by the highest point in the plot was 1942 which grew 18.5%. This growth corresponds to the top bracket in 1939 of $5 million or 7106 times per-capita GDP.

The scatter plot shows that over the last 90 years the top tax bracket has had a positive relationship with growth. This is demonstrated by the upward sloping best fit line in the scatter plot. The strongest year of growth, represented by the highest point in the plot was 1942 which grew 18.5%. This growth corresponds to the top bracket in 1939 of $5 million or 7106 times per-capita GDP.

There have been three distinct multi year periods where GDP annualized growing more than 7%: the early 1920s, the mid 1930s and the early 1940s. All three of these periods correspond with a top bracket of at least $1 million or over 1000 times per-capita GDP. The best growth came with the $5 million bracket.

On the other hand, cutting the top bracket from $5 million to $200,000 corresponds with the weakest year of growth outside The Great Depression.

The significant correlation of the top bracket’s influence on growth in recent years is somewhat hidden by the large variation in the top bracket prior to W.W.II. The post war period is shown separately in Figure G10.

The linear correlation of the top bracket to growth shown here is the first of 3 variables making up the GDP growth model shown in Figure G14. The other two are the influence of the top tax rate and the capital gains rate.

The tax policy model of unemployment suggests that current tax policy is consistent with an unemployment rate of 9.0%. The model is a regression of the curvilinear correlation of the capital gains tax rate in Figure E2 and the linear correlation of the top tax bracket in Figure E3.

The tax policy model of unemployment suggests that current tax policy is consistent with an unemployment rate of 9.0%. The model is a regression of the curvilinear correlation of the capital gains tax rate in Figure E2 and the linear correlation of the top tax bracket in Figure E3.