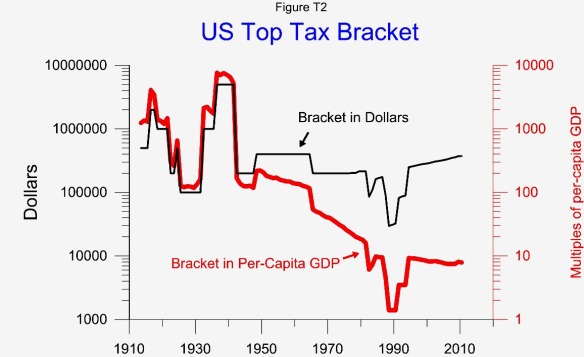

The top tax bracket is the income level above which the top marginal tax rate applies. In 2010 the top bracket for married filing jointly couples was $373,650. The portion of ordinary family income above this level was taxed at the top rate of 35%. The first $373,650 of family income was taxed at the lower marginal rates.

The top tax bracket is the income level above which the top marginal tax rate applies. In 2010 the top bracket for married filing jointly couples was $373,650. The portion of ordinary family income above this level was taxed at the top rate of 35%. The first $373,650 of family income was taxed at the lower marginal rates.

The top bracket has ranged from $29,000 to $5 million or from 1.4 times per-capita GDP to 7648 times. Currently the bracket is about 7.9 times per-capita GDP. The top bracket as a multiple of per-capita GDP has a stronger correlation with growth and job creation than as a dollar amount or an inflation adjusted dollar amount.

The top bracket to some degree represents the scope and progressivity of the tax system. When it was at $5 million it directly affected very few people, but represented a system with over 30 tax brackets.

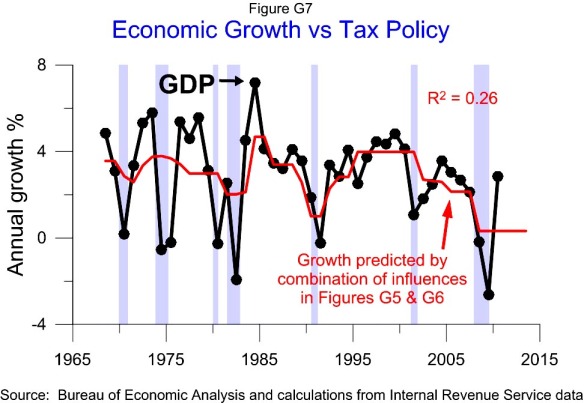

The top bracket has its strongest positive correlation to GDP growth leading 3 years. So a higher bracket this year would be a positive influence on GDP growth 3 years from now. The correlation is shown in Figures G9 and G10.