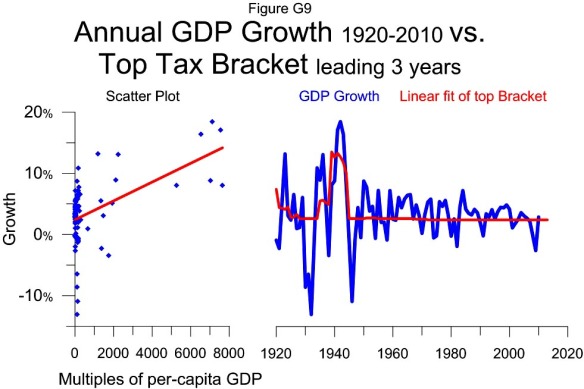

Growth in the post war period has a positive correlation with the top tax bracket. The growth corresponding to a top bracket above 80 times per-capita GDP annualized growing 4.1%. This is the data shown on the right side of the scatter plot or prior to 1968 on the time series plot. Growth influenced by a top bracket below 80 times has only annualized growing 2.9%. The low bracket data is represented on the left side of the scatter plot or since 1967 in the time series plot.

Growth in the post war period has a positive correlation with the top tax bracket. The growth corresponding to a top bracket above 80 times per-capita GDP annualized growing 4.1%. This is the data shown on the right side of the scatter plot or prior to 1968 on the time series plot. Growth influenced by a top bracket below 80 times has only annualized growing 2.9%. The low bracket data is represented on the left side of the scatter plot or since 1967 in the time series plot.

The breaking point between the high bracket and low bracket periods came when the top bracket was cut to $200,000 in 1965 from $400,000 in 1964. This cut started impacting growth about 3 years later in 1968. Another view of the high bracket and low bracket data is shown in Figure T3.