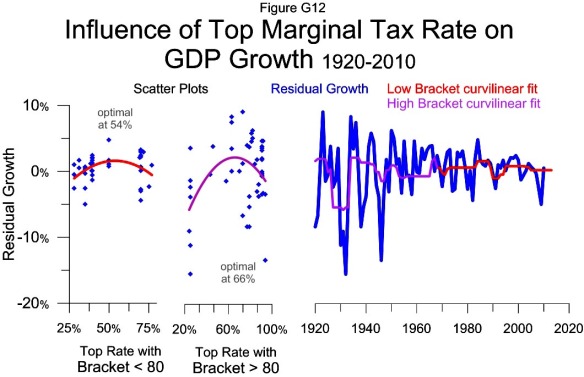

The two scatter plots show the curvilinear relationship between the capital gains tax rate and residual growth for the data when the top bracket was above and below 900 times per-capita GDP. The charts use the same five year lead time as previous charts showing the relationship between the capital gains tax rate and growth.

The two scatter plots show the curvilinear relationship between the capital gains tax rate and residual growth for the data when the top bracket was above and below 900 times per-capita GDP. The charts use the same five year lead time as previous charts showing the relationship between the capital gains tax rate and growth.

The red curvilinear fit line from the left scatter plot is the basis for the growth estimates shown in red on the time-series plot. The violet curvilinear fit line in the right scatter plot is the basis for the growth estimates shown in violet on the time-series plot.

The violet and red lines together show the influence of the capital gains tax rate on growth for the last 90 years. This influence combined with the influence of the top bracket and top tax rate make the model in Figure G14.

The residual growth is the actual growth less the influence of the top bracket; its construction is shown in Figure G11. The fastest year of residual growth was 1923 which grew 9% faster than the estimate based on the top bracket. This year corresponds to the 77% capital gains tax rate in 1918.

Having the capital gains rate estimate residual growth makes for a more natural combination of the two data ranges with different brackets. The different ranges for the top bracket are shown in Figure T3.