The capital gains tax rate leads the exchange traded index of the US dollar by about 7 years. Highs in the dollar in 1985 and 2002 correspond with highs in the capital gains tax rate in 1978 and 1995 respectively. The correlation suggests the dollar will remain weak for the next 7 years.

Tag Archives: capital gains tax rate

E2 Unemployment vs Capital Gains

The capital gains tax rate has a curvilinear relationship with the unemployment rate. The strongest correlation is with the capital gains rate leading by 6 years. The capital gains rate that minimizes unemployment appears to be about 24.7%, but any rate between 21% and 29% would help keep the unemployment rate low.

The capital gains tax rate has a curvilinear relationship with the unemployment rate. The strongest correlation is with the capital gains rate leading by 6 years. The capital gains rate that minimizes unemployment appears to be about 24.7%, but any rate between 21% and 29% would help keep the unemployment rate low.

The capital gains tax rate was raised to 39.9% in 1976 six years later the unemployment rate averaged 9.5% in 1982. The capital gains tax rate was cut to 15% in 2003 six year later unemployment averaged 9.3% in 2009. The correlation suggests that a 15% capital gains tax rate is consistent with a 9.1% unemployment rate.

While the current measure of unemployment only goes back to 1948, the correlation suggests that the 12.5% capital gains tax rate in place from 1922 to 1933 would have led to a 12.6% unemployment rate from 1928 through 1939.

The influence of the capital gains tax rate is combined with the influence of the top bracket in Figure E3 to make the unemployment model in Figure E4.

G13 Capital gains vs GDP Residual Growth 1920-2010

The two scatter plots show the curvilinear relationship between the capital gains tax rate and residual growth for the data when the top bracket was above and below 900 times per-capita GDP. The charts use the same five year lead time as previous charts showing the relationship between the capital gains tax rate and growth.

The two scatter plots show the curvilinear relationship between the capital gains tax rate and residual growth for the data when the top bracket was above and below 900 times per-capita GDP. The charts use the same five year lead time as previous charts showing the relationship between the capital gains tax rate and growth.

The red curvilinear fit line from the left scatter plot is the basis for the growth estimates shown in red on the time-series plot. The violet curvilinear fit line in the right scatter plot is the basis for the growth estimates shown in violet on the time-series plot.

The violet and red lines together show the influence of the capital gains tax rate on growth for the last 90 years. This influence combined with the influence of the top bracket and top tax rate make the model in Figure G14.

The residual growth is the actual growth less the influence of the top bracket; its construction is shown in Figure G11. The fastest year of residual growth was 1923 which grew 9% faster than the estimate based on the top bracket. This year corresponds to the 77% capital gains tax rate in 1918.

Having the capital gains rate estimate residual growth makes for a more natural combination of the two data ranges with different brackets. The different ranges for the top bracket are shown in Figure T3.

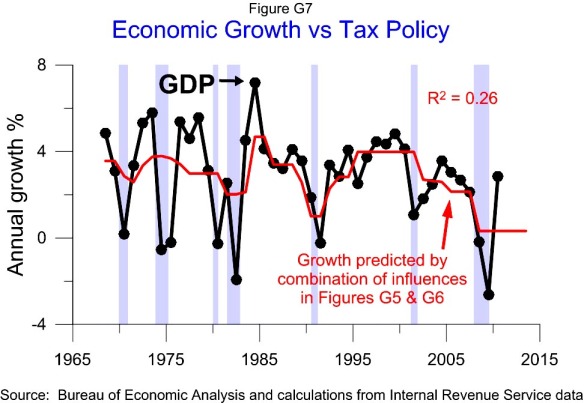

G7 Tax Policy vs GDP Growth 1968-2010

Figure G7 shows annual growth for GDP from 1968 to 2010 and the combined influence on growth from the curvilinear relationship of the top marginal tax rate on growth shown in Figure G5 and the curvilinear relationship of the capital gains tax rate shown in Figure G6.

Figure G7 shows annual growth for GDP from 1968 to 2010 and the combined influence on growth from the curvilinear relationship of the top marginal tax rate on growth shown in Figure G5 and the curvilinear relationship of the capital gains tax rate shown in Figure G6.

The curvilinear relationships of the tax rates with growth suggest the baseline growth rate for current tax policy is 0.3%. This is weaker than the forecast of the linear correlations shown in Figure G3.

Figure G8 shows the actual growth over 5 year periods and the 5 year rate of growth estimated by the above model.

To show the influence of tax policy on growth prior to 1968 requires showing the influence of the top tax bracket on growth and how the top bracket affects the growth optimizing tax rates. These correlations are covered in Figures T2, T3 and G9 –G15.

G6 Capital gains vs GDP Growth 1968-2010

This figure shows the curvilinear relationship between economic growth from 1968 to 2010 and the capital gains tax rate. Each point in the scatter plot shows the growth rate for one year with the capital gains rate from 5 years earlier. For example the highest point on the chart show that GDP grew 7.2% in 1984 and that the capital gains rate 5 years earlier in 1979 was 28%.

This figure shows the curvilinear relationship between economic growth from 1968 to 2010 and the capital gains tax rate. Each point in the scatter plot shows the growth rate for one year with the capital gains rate from 5 years earlier. For example the highest point on the chart show that GDP grew 7.2% in 1984 and that the capital gains rate 5 years earlier in 1979 was 28%.

The best fit curved red line in the scatter plot is used to make the model in the time series plot on the right. The data suggests that a capital gains tax rate of about 29.1% would maximize the growth rate and if the tax rate is above or below that level that growth will be weaker 5 years later.

The weakest growth on the chart, 2009, corresponds with a below optimal 15% capital gains tax rate. The next weakest year, 1982, was influenced by an above optimal 39.9% tax rate.

The influence of the capital gains tax rate on growth is combined with the effect of the top tax rate in Figure G5 to make a model that estimates growth in Figure G7.

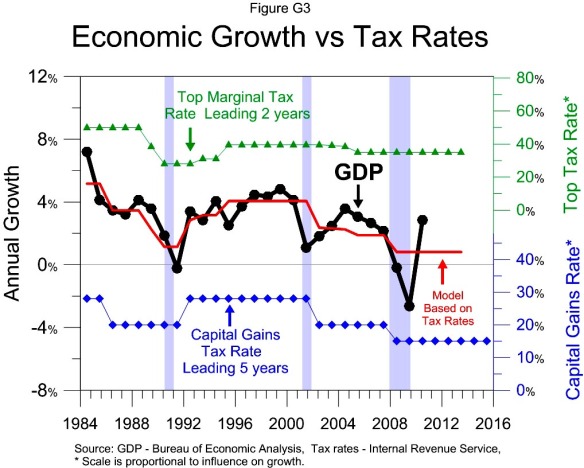

G3 Tax Policy vs GDP Growth 1984-2010

At a given tax bracket there is a growth optimizing top tax rate and capital gains tax rate. Since 1984 both tax rates have been below the growth maximizing level. The top rate (in green) leads growth 2 years. The capital gains rate (in blue) leads growth 5 years. Every tax rate cut in the chart corresponds with weaker growth while tax increases correspond to stronger growth. The model (in red) shows the combined influence of the two tax rates on growth. It predicts a baseline growth rate of 0.8% going forward.

At a given tax bracket there is a growth optimizing top tax rate and capital gains tax rate. Since 1984 both tax rates have been below the growth maximizing level. The top rate (in green) leads growth 2 years. The capital gains rate (in blue) leads growth 5 years. Every tax rate cut in the chart corresponds with weaker growth while tax increases correspond to stronger growth. The model (in red) shows the combined influence of the two tax rates on growth. It predicts a baseline growth rate of 0.8% going forward.

The strongest growth in 1984 corresponds with the highest tax rates in the period, 50% top rate and a 28% capital gains rate. The great recession corresponds to the lowest combination of tax rates. The Recession of 1990 corresponds to the next lowest combination.

Volatility in annual GDP growth may mask the significance of tax policy’s impact on growth. Figure G4 shows the growth rate over 5 year periods and the rate predicted by tax policy.

Looking back prior to 1984 requires showing the curvilinear relationships between growth and tax rates shown in Figures G5 – G8.

Looking back prior to 1968 requires examining growth’s relationship with the top tax bracket and how the top bracket influences the growth optimizing tax rates, as shown in Figure T2 and Figures G9 –G15.

T1 Tax Rates 1913-2010

The top tax rate has ranged from 7% to 94%. Only 15 of the 98 years since 1913 have had a top rate lower than the current 35%. The capital gains rate has ranged from 7% to 73%. Only 13 years have been lower than the current 15%. The current average of the top rate and capital gains rate at 25% is the lowest since the Great Depression.