The top tax bracket affects how the top tax rate and capital gains tax rate correlate with growth. As the top bracket moves higher the growth maximizing marginal tax rate also moves higher.

The top tax bracket affects how the top tax rate and capital gains tax rate correlate with growth. As the top bracket moves higher the growth maximizing marginal tax rate also moves higher.

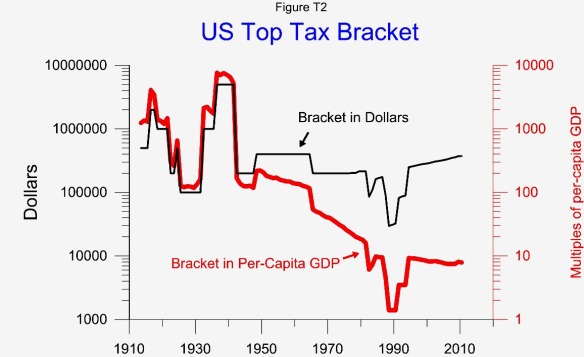

The top tax rate appears to have a growth maximizing rate of 54% when the top bracket is below 80 times per-capita GDP and a maximizing rate of 66% when the top bracket is above 80. The scatter plots showing these correlations are in Figure G12. Eighty times 2010 per-capita GDP was about $3.8 million.

The capital gains tax rate appears to have a growth maximizing rate of 28.7% when the top bracket is below 900 times per-capita GDP and a growth maximizing rate of 91% when it is above 900. The scatter plots showing these correlations are in Figure G13. Nine hundred times 2010 per-capita GDP is about $42.6 million.