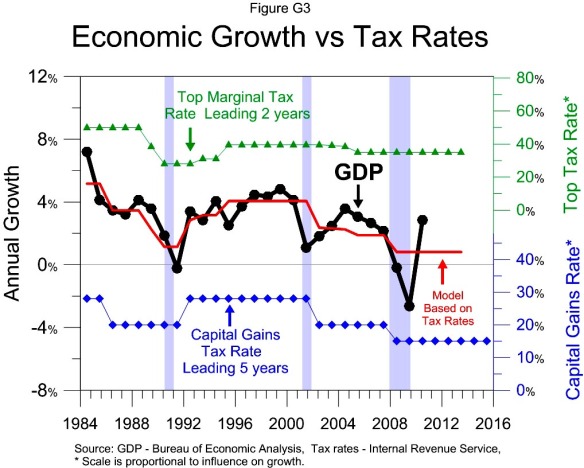

At a given tax bracket there is a growth optimizing top tax rate and capital gains tax rate. Since 1984 both tax rates have been below the growth maximizing level. The top rate (in green) leads growth 2 years. The capital gains rate (in blue) leads growth 5 years. Every tax rate cut in the chart corresponds with weaker growth while tax increases correspond to stronger growth. The model (in red) shows the combined influence of the two tax rates on growth. It predicts a baseline growth rate of 0.8% going forward.

At a given tax bracket there is a growth optimizing top tax rate and capital gains tax rate. Since 1984 both tax rates have been below the growth maximizing level. The top rate (in green) leads growth 2 years. The capital gains rate (in blue) leads growth 5 years. Every tax rate cut in the chart corresponds with weaker growth while tax increases correspond to stronger growth. The model (in red) shows the combined influence of the two tax rates on growth. It predicts a baseline growth rate of 0.8% going forward.

The strongest growth in 1984 corresponds with the highest tax rates in the period, 50% top rate and a 28% capital gains rate. The great recession corresponds to the lowest combination of tax rates. The Recession of 1990 corresponds to the next lowest combination.

Volatility in annual GDP growth may mask the significance of tax policy’s impact on growth. Figure G4 shows the growth rate over 5 year periods and the rate predicted by tax policy.

Looking back prior to 1984 requires showing the curvilinear relationships between growth and tax rates shown in Figures G5 – G8.

Looking back prior to 1968 requires examining growth’s relationship with the top tax bracket and how the top bracket influences the growth optimizing tax rates, as shown in Figure T2 and Figures G9 –G15.